Six years after the 2008 banking crash, there have been some small tweaks, but little structural reform of the financial sector and nothing has been done to deal with the fundamental causes of the financial crisis.

..

Organised gambling and anti-social practices by the banks undermined the stability of the entire economy, yet to all intents and purposes it remains business as usual for the financial elite. The state, most notably the US, has occasionally bitten back, but fines have just become another cost of doing business. Rear-guard action by financial elites to protect the selfish games of the banking sector has resulted in only paltry changes to regulation.

Neoliberalism, the dominant ideology since the 1970s, focuses on deregulation and the endless pursuit of private wealth. The corrosive effects of neoliberalist values have been most evident in the financial sector, where profits have been made from selling abusive financial products, money laundering, tax avoidance, sanction busting, speculation on commodities and land, takeovers and insider trading. There are no constraints on speculative activities and financiers routinely gamble ordinary people’s savings and pensions on an unprecedented scale. This reckless gambling produces little, if any, real additional wealth, but its destructive effects have had serious consequences for the average household and the wider economy.

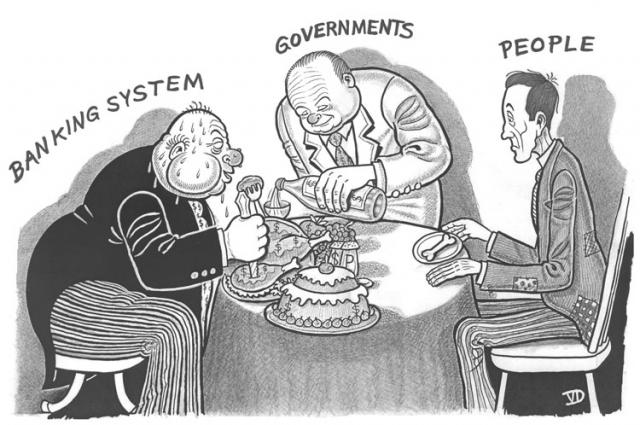

It is hard to find any major bank that did not seek to fill its coffers by abusive practices. When the crash landed, banks like Northern Rock, Bradford & Bingley, HBOS and Royal Bank of Scotland faced a liquidity crisis and the state stepped in to rescue them, pouring in billions to support the ailing industry. Neoliberalism has created perverse incentives for distortions in the financial sector where profits are privatised and losses are socialised. Contrary to neoliberal claims, the state has not been rolled-back, but instead has been absolutely central to the survival of the financial sector. The state has been restructured to support the corporate sector, and guarantee profits. It has bailed out banks and shielded them from public scrutiny. The state, rather than the market, has committed loans and guarantees of £977 billion² to support distressed banks; and under Quantitative Easing, the Bank of England has given £375 billion³, about £16,000 per household to the banks. While ‘nationalisation’ has not been mentioned, the effects on the public purse are the same.

The financial sector has colonised the state in such a way that political power has been subordinated to corporate interests. Through their capture of the state, neoliberals have diluted, if not eliminated, the risk of business bankruptcy in the financial sector. For decades, the sector has been engaged in a series of malpractices, but has been bailed out. Its executives have inflicted enormous social harms through engaging in anti-social practices, but continue to collect massive remuneration packages. There is an urgent need for reforms that check the worst excesses of neoliberalism by strengthening democratic control and accountability in the banking sector.

This paper suggests a number of reforms:

1. Separate retail and speculative banking

2. Legislate for approval to be sought before investment banking can be financed with public funds

3. Restrict access to public courts for financial corporations

4. Introduce a financial transactions tax

5. Break the link between regulators and industry insiders

6. Emphasise public interest over market pressures

7. Publicise remuneration contracts

8. Make banks a central part of the community

9. Ensure greater transparency

10. Make tax returns public in order to tackle tax avoidance

11. End private auditing

12. Ensure regular reviews of the banking industry

On their own, they will not solve the deep-seated crisis in our financial sector, but they will provide an important starting point for long-term reform.

download paper source

More Stories

Navalny’s death used to hide western failures in Ukraine and their support for Israel’s genocide

Gifts from Gaza

Vulture capital circles over the corpse of Ukraine…